Summary

In episode 12 of Thinking Independently, Nick LoPresti and Conor Delaney discuss the importance of a growth mindset in business, particularly for financial advisors. They explore the journey of personal and professional growth, the significance of self-discipline, and the need for accountability. The discussion also touches on defining growth metrics, the balance between enterprise value and impact, and the role of values in shaping client relationships and organizational culture. Ultimately, they emphasize the necessity of aligning personal purpose with business goals to foster a thriving practice.

Takeaways

- Growth is about being better tomorrow than today.

- Self-discipline is essential for achieving growth.

- Accountability starts with oneself.

- Advisors must define what growth means to them.

- Values attract the right clients and shape culture.

- A winning culture is crucial for long-term success.

- Purpose should drive business decisions, not just profit.

- Reigniting a growth mindset can transform practices.

- Metrics should reflect personal and business growth goals.

- Change and reinvention are necessary for success.

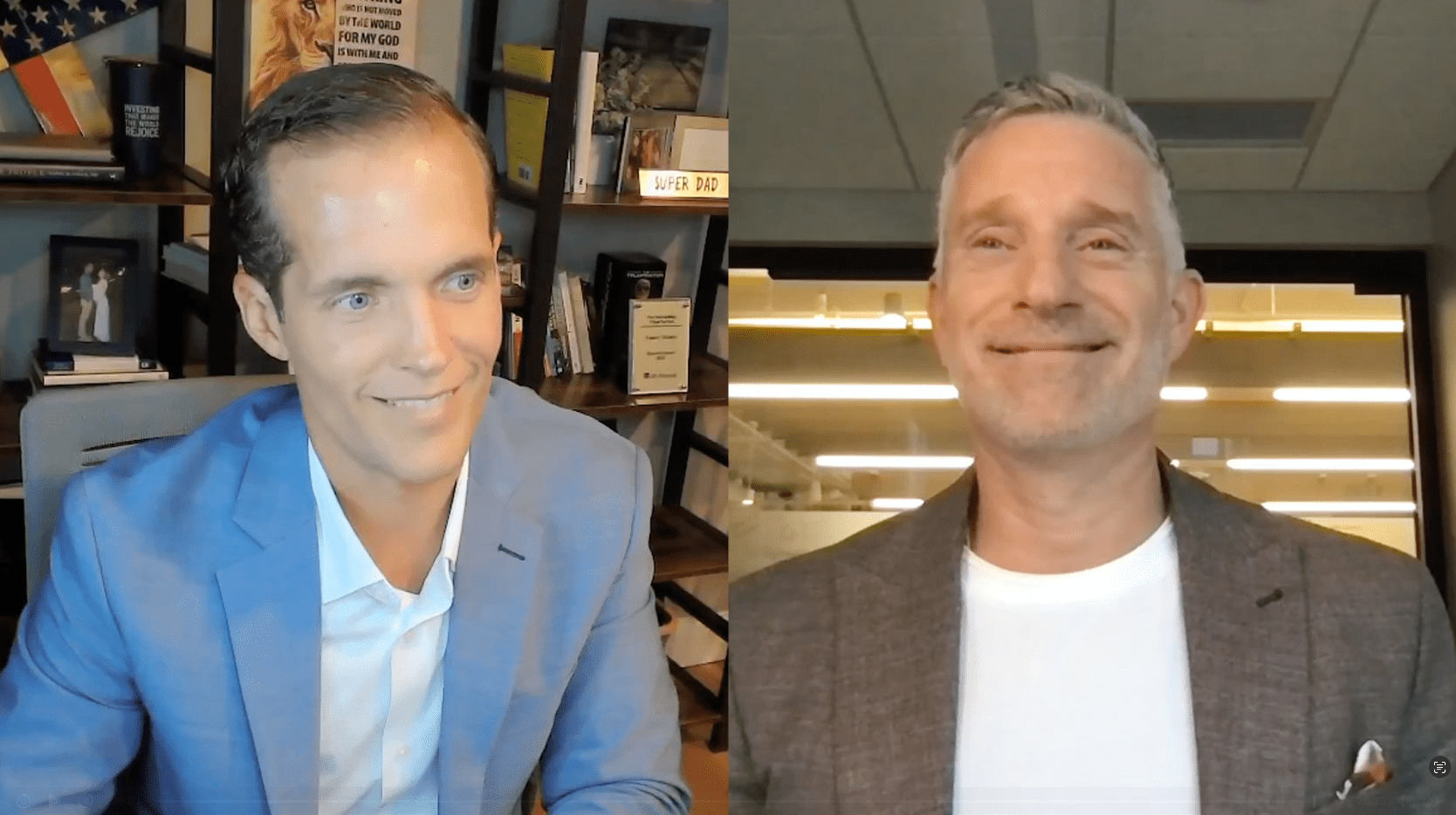

Welcome back to Thinking Independently. I’m Nick LoPresti, Chief of Staff at Good Life. Pleased to introduce our Chief Executive Officer, Conor Delaney.

Nick LoPresti (00:00)

Welcome back to Thinking Independently. I’m Nick LoPresti, Chief of Staff at Good Life. Pleased to introduce our Chief Executive Officer, Conor Delaney. Good afternoon, sir.

Conor Delaney (00:12)

Good afternoon, how are you?

Nick LoPresti (00:14)

can’t complain for this particular day of the week. A lot of exciting things going on right now. We’re starting to move into that time of the year where there’s sort of a reinvigoration of the business, I think. Maybe summer coming to a little bit of close. The vacations are behind everybody. And so now we’re moving into, hey, how do I get back to business? And you know,

thinking about growth and what am I gonna do to finish the year strong and set up my next year? So all those things are kinda happening around the organization, but for you, give us just a little bit about, we’re working towards the 777, seven marathons, seven days, seven continents. How’s the training?

Conor Delaney (00:57)

It’s going, man. It’s going really well. think the topic of the day today is interesting because I think there’s a lot to reflect on. Even since I started training for this back in the springtime, the idea of growth is definitely something that, you know, it’s hard when you start to train for something or you start to set an aspirational goal to do something. The first couple of weeks, it’s hard to get into it because you don’t see the body of work yet.

then you get that opportunity to look back. Now, having really just picked up the training for this in April, looking back several months down the road, you can say, okay, well, I’m further along than where I started. And not to create a total metaphor, but for me, everything is judged by the positioning of the heart and how the heart is kind of reconditioning itself through workouts. And I was even looking yesterday, just said a 10 mile workout yesterday, which is on the sort of…

smaller end of the scope right now, just where we are in the training. And I looked at my average heart rate and it was 133. And, um, the first time that I did a 10 mile run, going back to the spring, my heart rate was 168 and I was 40 seconds slower per mile. So it’s, it’s interesting not to be again, not to tie this metaphorically together, but it’s all about the conditioning of the heart. If that heart is, is, know,

locked in and loaded. I don’t care if you’re running a race or you’re pursuing a goal in your business aspirationally, there is some cool things that can happen when the heart is ready to take on whatever the challenge is before them. That’s a pretty good metaphor. mean, we kind of fell into that. That’s pretty good.

Nick LoPresti (02:27)

Yeah, I mean.

I thought it made a lot of sense. And so where you are now, right, and this is something that you kind of said not only to me, but others around the organization. I’ve heard you talk about it with advisors and it’s sort of that link between you, the individual business owner, your health, and how that affects your business, right? And lot of it is sort of mindset.

So how do you think about that growth mindset being more than just a number?

Conor Delaney (03:02)

Yeah, I think when we talk about growth in general, I think when you look at sort of what’s the definition of growth or when you think somebody is ready to take on some sort of growth trajectory, think bottom line is it kind of boils down to being better today, being better in the future than we are today, being better tomorrow than we are today. That’s kind of how I would sort of set at a very fundamental elementary level.

We have to aspire to be a better version at some point in the future than we are today. That is the basic formula and the core tenets of growth. And it’s interesting. We talked about the kind of calendar year and where we are in the year. It’s pretty cyclical, right? You have like the end of the year. Everyone’s like, you know, I’m going to go and do it next year. I’m going to get out started in the first quarter. I’m going to start that new diet or I’m going to grow my business or I’m going to redo my product offering or whatever the case is.

And then the second quarter, kind of get into either a groove or into excuse land. And then third quarter is kind of that lull like, man, we’re going to do this. And then the fourth quarter is like, Hey, we don’t need to worry about growth last year. We got growth next year to focus on, you know, and it’s kind of this then rinse and repeat and go through it again. I think it’s interesting when you think about the path for independent advisors where, you know, when you go independent, you kind of lose that person that’s sort of cracking the whip, right? To say like,

you’re off plan, you’re behind the mark or whatever. so it’s kind of like when you maybe go off to school for the first time and you don’t have mom and dad kind of setting the alarm clock for you and making sure that you’re up and ready to go to school. The idea of growth, the core sort of tenets for setting up the right landscape for growth to happen, to me, it revolves around self-discipline. If you’re not ready to walk that out in a way that’s going to be

that’s going to aspirationally desire to be better tomorrow than you were today, then growth is just never gonna be in your future.

Nick LoPresti (04:56)

Yeah, and the importance of accountability, right? You got to have that accountability. And who are you most accountable to? Yourself, right? You’re always most accountable to yourself. And so that’s where that growth mindset, you come back to the, you know, what is the growth mindset? You think about the belief of doing something bigger than what you’re doing today, perhaps, right? And a lot of advisors at some point tend to

Conor Delaney (05:08)

Yeah.

Nick LoPresti (05:26)

kind of fall out of that mindset that there’s more to be had, that there’s more that you could accomplish. So how do you, for yourself and for the advisors that we work with, how do we try and keep those, how do we keep that growth mindset in front of them on an ongoing basis?

Conor Delaney (05:30)

I’m gonna make you

I think you, you, you’re touching on something that is really one of the fundamental disadvantages of being independent. and maybe it’s presented to, to, advisors differently before they make that jump. So I go back to my journey when I went independent and one, there was nobody more excited than, than I was to get out of the culture of sales and really try to adopt that culture of service. But for me, it was because.

I guess I’m a rule breaker that didn’t want somebody to tell me how to do, when to do, what to do. But I think for a lot of people, it’s because that pressure, feeling like you’re in that pressure cooker of sales eventually leads to burnout and things like that. And so you go independent and all of a sudden growth isn’t a priority anymore because sales isn’t a priority anymore. And hitting certain business numbers isn’t a priority anymore. And then you could kind of fall into this trap without that accountability that you’re talking about.

which had a title associated with it of sales manager or regional manager or whatever the case was, all of a sudden that person’s gone. And you know, that first year, I’m not sure that growth is a prerogative. It’s more, hey, let me get my feet underneath me. And we tend to fall into comfort land, especially when you’re going from a land of 30 % payout to 80 % payout. Hey, I can do half as much effort and make the same or a little bit more money.

To me, that kind of creates this scenario that doesn’t always yield the best fruit than how you operate it in function. Even though you’re in a completely dysfunctional business model at a wirehouse or a regional or something like that, the constraints that were put on you forced you to grow even if growth wasn’t something that you were prepared to walk into. So it’s a weird sort of balance that a lot of folks didn’t necessarily

anticipate or at least anticipate the effects of what it did to us when we went independent.

Nick LoPresti (07:42)

Yeah, and then I agree with what you’re saying. You think about so many advisors will come and say, well, I am growing. I was well evidenced by what? What is growing besides my waistline as I get older, right? What is growing in your business? Is it new clients? Is it new assets? Is it revenues growing? Like, what’s the metric that you really lean into with advisors?

around the idea of growth. Like what’s the metric, the KPI, that you would be leaning into with them to make sure that this is what’s growing?

Conor Delaney (08:18)

We need to do that on the next one.

So I think first it’s like that clear, like we talked about that clear definition of what growth is. You know, I think growth is a derivative of a underlying desire to not participate in the status quo, to not accept sort of the what is without at least pondering what can be. And if if, if advisors can at least be curious and interested to, to think about that question, to ponder what, what can be instead of living in the whole, it’s cool and comfortable right now.

then you can start to define what growth might look like and whether that’s growth as you related to impact, growth as you related to the actual dollars growing in your bottom line, right? Income, I used to in a weird way look at a KPI in terms of how many employees we had. And so if we were adding employees and we had the good fortune of creating a job,

I always liked that as sort of an indicator, although you could make the argument that people create jobs just to create jobs without really any tasks associated with it. But I think if you kind of put all that stuff together, that’s that’s where you can start to once you understand what the definition of growth is, then it’s personal to people, whether that means I’m going to define growth by making more money, driving a bigger impact, etc. And as you and I were talking about separately earlier today, I think

there’s a correlation, but a difference between growth when you think about how many clients you’re adding versus growth when you think about the amount of impact you’re making. And I think again, without proper coaching, people can get caught in any one of those sort of rabbit holes and it’s hard to pull yourself out without a plan.

Nick LoPresti (10:02)

Yeah, sort of what is the significance that I’m bringing to the table through this business?

Conor Delaney (10:07)

Yeah, yeah, exactly.

Nick LoPresti (10:09)

Well, what about where do you factor in things like enterprise value? As individual operators, as individual business owners, how important in the decision-making process is the enterprise value?

Conor Delaney (10:23)

So I think that for at least for us, I you can look just at the definition of enterprise value and you can look at what it takes to grow the enterprise value. But I think, you know, there’s a difference between enterprise value and enterprise equity in the community that you serve. so enterprise value is like, hey, for example, you know, I’m only going to take clients that look this way that we can generate a certain amount of profit off of.

And if we do that the right way, then we can bring in X amount of clients before we need Y amount of junior advisors or support staff or whatever the case is. And I think the, the advisor that is thinking sort of a little bit differently or more maturely about that line of questioning would start to think like, Hey, that’s all well and good, but is there not an apex of sorts where you would say, where does that sort of intersection sit between the, the, the pure synthetic

bottom line dollars that we’re putting into the business or that we’re netting out of the business versus the impact that the business is making. I mean, there are firms out there that we see them all over advertisements on TV that are generating tons of money and they have a formula to say, can buy more commercials to get more people to invest in the…

the sort of mediocre way that we look at asset management and we can do this with this super wide net across all 50 states and make a lot of money. But where’s that sort of enterprise and sort of brand equity, right? You know, versus, this guy is just sort of running a chop shop. I think that’s again, that’s something that each individual advisor has to determine. Like, do I want to have deep, meaningful relationships? And if so,

What does that look like in terms of my growth formula and how I determine value? Or do I want to sort of have a more macro look where I’m saying, hey, I’m only looking at number of households served, amount of profit that we’re making per household in order to drive this outcome for my stakeholders because my stakeholders are the ones that are the most important thing to me in terms of priority of how I’m defining.

growth and success inside of my enterprise. And really no wrong answer. It’s it’s how the individual group determines their definition of success. The downline effect of that is culture, right? If you have this organization that cares deeply about making sure that everybody possible that wants access to financial advice can get it, that

looks different than the company that’s saying, hey, I am only interested in driving my net profit for the purpose of my stakeholders because they’re the thing that’s most important for me. Two different outcomes, not sure either one of them is wrong. It’s just what organization do you want to be associated with and what organization, if you have the opportunity, do you want the privilege to lead and to drive the vision to et cetera? Because you can pick either one of those models and still find success, you know?

Nick LoPresti (13:26)

Yep,

absolutely. And I think one of the things that we’re getting really good at and working with our advisors specifically is, you know, helping them with that mindset, right? Moving them from that mindset of complacency sometimes that we’re in and shifting them back into a growth mindset, which is hard to maintain when you’ve been in the business for 20 years or 25 years or 30 years, right?

You get exhausted from the day-to-day experiences of running the business. I think that’s one of the things that we’ve been very intentional about is helping advisors regain that competitive edge, perhaps. I’m not sure if that’s the right word, but that growth mindset that there is more available I can do here if I have the tools and the resources that can take some of the things out of my plate that are exhausting for me.

paperwork or compliance issues or whatever the case might be and help them really rethink the way they look at their business. And we’ve got a population of advisors that we’ve worked with over the last 12 to 18 months that the data would show this group is growing faster than anybody else in our system.

Conor Delaney (14:41)

Yeah. So here’s the thing. think when you, when you really look at it, what is the thing that motivates people, you know, and, I feel like people oftentimes will define success as like, Hey, I have enough to, you know, cover my needs, right? First level of master’s hierarchy, second level cover my wants needs and wants in this business that we’ve had the privilege of being in for all of our adult lives. Like

It’s pretty awesome that you can sit as a financial advisor in your 20s. And if you are willing to put in the effort and have the heart to do it, you can go out and make a ton of money. But what happens is people sort of will then fall resting their lower 20 years into it. I’m making enough. I have enough. And I think like what’s been interesting is people will look differently to say the people that are getting it. So for me, I’m motivated now.

by two things. One, it’s that legacy that we are, that I promised my kids. It’s that I’m going to break the generational curse of poverty and bless my kids with a better life than the one that I had. One. Two, it’s if you can walk in the God given call for your life. What I mean by that is like that takes the money as the motivator out of the way. And it says like, man, I’ve been blessed with a mind that allows me to walk the everyday client through a financial planning process.

so that they can get a better outcome as a result of the skills that God has placed in me, in my mind, in my heart to do and perform on, than they would have been if they didn’t have me. And that, I never sat and said, well, what’s my cashflow on this? Because cashflow was level one of Maslow’s hierarchy. I had that, had the needs, had the wants. Self-actualization, what is my purpose for being here? And when you can unlock that for advisors,

and then surround that with the right business acumens, that’s where I think people start to get charged up and fired up. Sure, we all wanna compete and we all wanna be better and we all wanna make more. But if you can help people tap into their purpose, that to me gets people off the couch and gets them.

Nick LoPresti (16:47)

Yep. And if you could, if you could think about once you get an advisor who’s really in that growth mindset again, and there’s a lot of ways that advisors can grow, right? I mean, you could, they could add new advisors to their teams. They could acquire another book of business. You know, they could tap into strategic relationships with CPAs and attorneys. There’s lead gen programs. There’s, you know,

maximizing SEO on their website. If you could give advice to advisors who might be listening, like what’s the one area that you would say, if you’re gonna apply that growth mindset, this is the lever you should be looking at right now.

Conor Delaney (17:29)

So let me come back to that by asking you something. What do you think’s the number one reason why America’s football team hasn’t won a championship in 30 years?

Nick LoPresti (17:38)

Is that the Dallas Cowboys?

Conor Delaney (17:40)

It is.

Nick LoPresti (17:41)

because for the Bears, it’s 40 years. I just want to get that out there. So if we can use that one, it’s a little nearer dear to my heart. I think it’s lack of, at the top, that there’s not a winning culture at the top of the organization.

Conor Delaney (17:44)

Hahaha

Yeah, I mean, I would agree with that. think it’s that you got a guy that can’t get out of his own way. He’s made it all about him and less about the greater goal. And so to come back to your question, like what’s the number one formula that leads to long term success for individual financial planning practices to experience the ability of making a big time change in the communities that they serve? And for us to see this as a witness to the

hundreds of communities that we have the privilege of supporting advisors in, the guys that are doing it best and the gals that are doing it best are the ones that got out of the way. They’re the ones that said, this isn’t, I’m not the brand, right? Okay, there’s outliers out there. There’s complete people, there’s people out there that have their name on the side of buildings and planes and all well and good, right? And so they’re the outliers. They’ve established this world-class success by the way that it’s measured in the world and they’ve made it all about themselves.

But I would still submit that those that do it best, whether you’re a financial advisor, a coach, or an owner of a football team, the wheels stay on the bus when you take yourself out of the way and you put the purpose as the thing that you’re aspiring to get to instead of you being the bottleneck in that. mean, dude, take the Patriots. Patriots were awesome, right? Now what did the Patriots experience? They’re experiencing craft saying, I’m better than everybody else.

I’m the one that put together the winning organization. I came in here, bought this team and saved the day. And you know what he’s done since he said, I’m bigger than Bill, I’m bigger than Tom, I’m bigger than the people that came around me to help me build a winning organization. You know what they keep doing? Losing. The minute Kraft gets out of the way, the minute Jones gets out of the way, and they start to say that, what is the purpose that we’re trying to aspire to? And how do we build a winning culture and not make it all about themselves?

It’s when those guys start winning championships again. And I think that that is the hardest thing to pull off as an advisor, especially because as advisors, we are the product, right? Especially in the early years before you have infrastructure around you. But as you can grow this to the next level, to the next level, to the next level, it’s about taking yourself out and putting the purpose in. That I think is the main thing that, you know, once you do that, all the other pieces start to fall in line.

Now I know where I’m going to go to go and get the type of client that I want. Now I know the strategy I’m going to put in place to acquire those clients. And I also know that none of that stuff is Connor dependent. It’s dependent on the mission and the team and the people that you put around you, far more so than it is about you.

Nick LoPresti (20:33)

And it sounds like there needs to be, like what you’re talking about, I think too, more broadly even, is the idea of returning to the values of your organization and knowing what those values are, right? What are the principles that you subscribe to as the business owner that you sort of hold yourself out into the community to, know, kind of think back to where you said just a few minutes ago. Like where do values fit into all of this?

Conor Delaney (20:59)

Yeah, actually, that’s a good point. I maybe we maybe the industry, especially the independent sector, has has has said the wrong, you know, sort of mission statement for going independent for I was told going you could pick whatever clients you want and you could take whatever clients you want and you get to handpick the way that your business is going to run and you get to make as much money as you want. And I would say you probably need to start with

hey, you don’t need to conform to somebody else’s values or culture statement anymore. You can start to insert your own. And if people are, it’s a value system worth following, if it’s a culture worth following, the clients are gonna come. Not only are gonna come, but it’s gonna be the clients that you like, that you do wanna work with because they’re gonna align with your mission. So maybe instead of saying, hey, go through your book and pick the clients you want, it’s hey, if you could burn down

the values of this new company that, or this company that has been around for 80 years and has now changed their values to create these new values that don’t align with anything that you or your clients stand for. If you could throw all that out the window, what would you stand for? What would your values be? And then once you have that defined, then you can start to develop how you’re going to go ahead and select the type of clients that you want to work with. And like I said,

I think naturally, if you’re leading with those values, the clients are going to come.

Nick LoPresti (22:26)

Yeah. And that, know, this is the time of the year where a lot of advisors start to pull their, their teams together and start laying out their strategies and focus for 2026. I know a lot of our teams do some offsite meetings and things like that, but they’re starting to look at what they want to do in 2026 and where they want to be intentionally growing next year. Sounds to me like a good piece of advice would be to include.

Conor Delaney (22:47)

Thank

Nick LoPresti (22:55)

a values conversation with their organization. What do we stand for? Get alignment from their team on that. I think that’s an important piece that sometimes gets overlooked when we talk about growth. Because you said it just right. It ultimately speaks to culture, which gets back to the values that that team brings to the table. So well said.

Conor Delaney (23:17)

Yeah, it’s a point. I mean, it’s front and center with us, right? Having just walked through a summer of really reflecting on those values. And I mean, for me, once we’ve come through that exercise, it just becomes crystal clear what the mission is. And it becomes crystal clear with, you know, in terms of who do we want on board for that mission, you know? And so, you know, I think that would be a great exercise for

advisors to walk through. don’t care how big the organization is, if it’s you and one other admin, not only to do it in the business world, but to do it as a family too. I even to look at and say like, as a family, what do we stand for? And how do we want to leave an imprint and an impact on the community that we live in and that we have the good fortune to serve? know, when, especially if you’re an advisor that is coming out of a place that had a toxic environment or wasn’t really manifesting culture the right way.

You know, they kind of have built this great trifecta on the other side of the fence from where we came from, which is, you know, Hey, crappy culture, um, uh, crappy payout and, um, crappy and client experience. Well, you know, if you can come over and solve that, uh, that then becomes a great basis for why you would make a move. Um, now notice we’re not talking necessarily right out of the gate about cashflow, transition to systems and.

and enterprise value. Those things will manifest if you get those first couple pieces right, you know.

Nick LoPresti (24:46)

Agreed. Yeah. Great dialogue today as always. And I know that Good Life stands ready for any advisor that wants further dialogue on this. You don’t have to be with Good Life to have a values conversation with us. We’re happy to tap in any time. But I think we nailed a couple things today that were super important about that growth mindset and how that leads to that growth, being intentional about what areas of your practice you want to.

Grow, like I’m growing. Let’s be more intentional about what it is that’s growing, what you want to have growth. And then ultimately taking it all the way back to what do I stand for? What are the values of my organization? So any final thoughts you want to offer up?

Conor Delaney (25:32)

Yeah, I would just say three things. Be humble, be willing along the same vein, be willing to change and grow and reinvent yourself. And if you do those two things right, then the idea of reimagining what your practice looks like in, 2026 and beyond, it’s going to be a much easier journey than if you’re trying to sort of till that field without a plan.

Nick LoPresti (25:52)

Well, this was Thinking Independently with Connor Delaney. Thanks, Connor, for joining us today. We’ll be back again soon with more fun topics and look, tis the season, so bear down.

Conor Delaney (26:01)

Yes, sir. Thanks, Nick.

You had to throw that in there at the end.

Disclaimer

The opinions voiced in this podcast are for general information only and are not intended to provide specific advice or recommendations for any individual to determine which strategies or investments may be suitable for you. Consult the appropriate qualified professional prior to making a decision. The economic forecast set forth may not develop as predicted, and there can be no guarantee that the strategies promoted will be successful. All performance referenced as historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.